Best Conveyancing Property Lawyers and Solicitors in Essendon and Sunshine

For most people, investing in a commercial or residential property is a momentous decision. This investment may include selling, buying, or even transferring property title. At Daniel Lawyers & Associates, we have experienced as well as competent Conveyancing property lawyers. As a firm with over 65 years of solid footing in legal affairs in Essendon and Sunshine, we have seen a plethora of cases. Hence, our legal experts can present clients with solutions to any legal problems on time.

Additionally, we believe that property transactions must only be delegated to experienced law firms because many case laws are highly relevant to property disputes, making property law a complex affair. Furthermore, we pride ourselves on housing some of Essendon and Sunshine’s essential property lawyers to deal with the various forms of property ownership and tenancy, such as buying, leasing, selling, subdividing, investing, or transferring a property.

What Is Conveyancing?

Conveyancing is the legal process that allows the transfer of real estate ownership from one entity to another. Our lawyers ensure that all clients receive sound advice regarding all property transactions and transfers.

These may include the following:

- Selling and buying both commercials as well as industrial property

- Contracts for the sale or purchase of a business

- Subdivisions and new titles

- Commercial as well as retail leases

At Daniel Lawyers & Associates, we understand that conveyancing is a complex affair. We have legal experts who help clients with many issues, such as real estate agents, pool fencing, planning & zoning advice. Moreover, our property conveyancing lawyers have the remarkable ability to assist clients while negotiating the very terms of the contract of sale. Therefore, we ensure that everyone in our client base is provided with pre-purchase advice. We also review the sales documentation before any purchase.

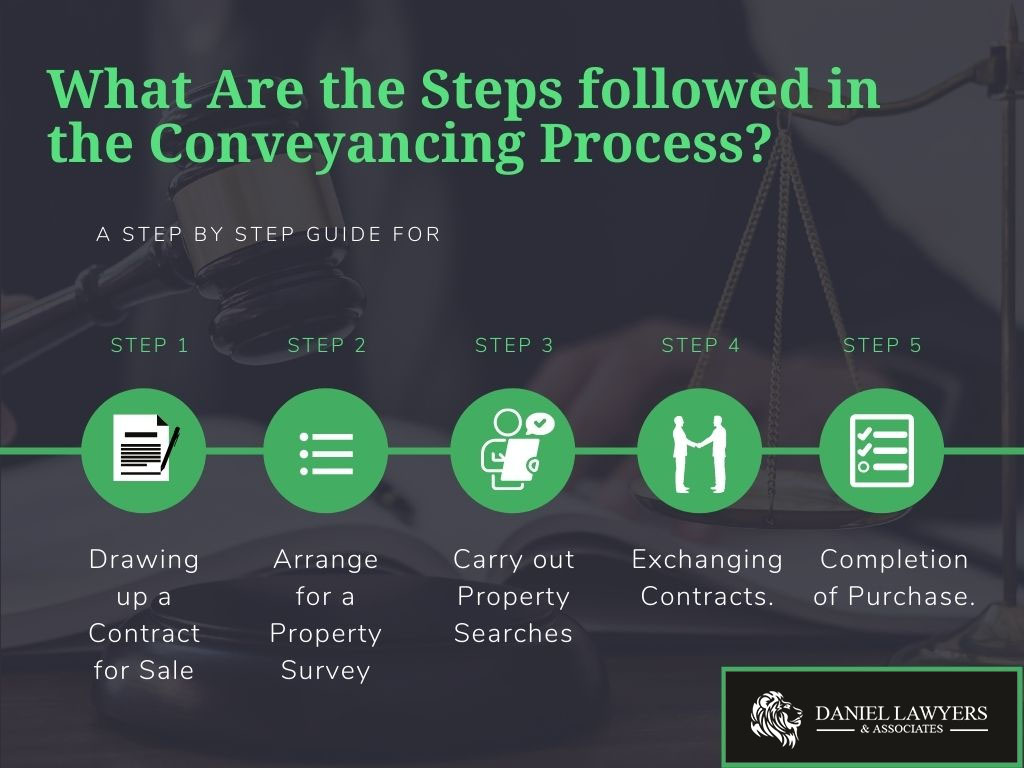

What Are the Steps followed in the Conveyancing Process- A Step by Step Guide

Step 1. Drawing up a Contract for Sale:

Typically, once the property offer has been accepted, you need to draw up a Contract for Sale by seeking the help of experienced conveyancing solicitors. Moving on, the details of solicitors from both sides would be exchanged by the appointed estate agent. It is only then that the solicitor from the seller’s side would send your conveyancer the contract pack that also includes other documents such as Property Information Form as well as Fittings and Contents Form.

Step 2. Arrange for a Property Survey:

Before signing the contract, you will be required to obtain legal advice, review the contract, arrange inspections, and gather funds. This survey not only highlights the faults present in the property, but also makes you aware of the potentially expensive repairs it may need. This information is useful for renegotiating the price of the property.

Step 3. Carry out Property Searches:

Property searches are typically carried out in the cooling off period between the signing of the contract and the settlement of the contract. Apart from just carrying out property searches, as a buyer, you would have to commit to paying stamp duty, organising insurance, and gathering funds. Additionally, the property seller would have to ensure that they are on top of all arrangements with the bank, such as discharging a mortgage. Furthermore, the seller will also have to make plans to move.

Step 4: Exchanging Contracts:

Before settlement, it is essential to ensure that all adjustments to the purchase price are agreed upon between both the parties. This may include the charges required to cover the council and a variety of other costs that may incur in the contract. In order to ensure that no changes have been made to the property since the initial checks, your solicitor would need to conduct a final check with the Land Register.

Step 5: Completion of Purchase:

The day the sale is finalised and also the property is legally handed over is called Completion day. Conventionally, most popular property lawyers and solicitors ensure that everything is in place on the day of settlement. Their influence is not only vital to ensure that the purchaser or the incoming mortgagee shows up with the funds but also to ensure that the seller or outgoing mortgagee turns up with the property title and the documents required for releasing the mortgage. Everything is handed over, including the keys, and the property is considered settled.

Step 6: After Completion of Purchase:

After settlement, you should enlist yourself as the new owner on the title. Furthermore, you would also have to inform various other government bodies about this change in ownership.

What Is the “Cooling Off Period”?

Conventionally, cooling off is a term used to describe the right of a purchaser of real estate that allows them to cancel the contract and walk away from the purchase within a specified timeframe without having the absolute need to provide a reason for doing so.

Essentially, in Victoria, a purchaser has three clear business days, from the day on which they sign an offer to purchase, to walk out of the deal, or in other words, “cool off”. However, there are some exceptions to the right to cool off.

These exceptions include the following:

- The sale is at or within three clear business days before or after a publicly advertised auction.

- The property is predominantly used for commercial or industrial purposes.

- Generally, the property is greater than 20 hectares and is primarily used for farming.

- The vendor and purchaser have previously entered into a contract for the same property in substantially similar terms.

Buying or selling a property is one of the most pivotal financial decisions. Hence, at Daniel Lawyers & Associates, legal experts advise clients only to consider sound, diligent advice. Get in touch with us on (03) 9687 3211 for 30-minute phone consultation or email us at enquiries@daniellawyers.com.au.